Today the ES and the SPO tested downtrend line from the 1368 highs and so far its being respected. Theres a couple things that I want to point out here 1. downtrendline 2. how well it was respected/the back and fill type action I seeing after it traded and now during the globex overnight session. 3. I have been watching the volume closly on the push higher and today looked concerning imo. Im thinking the ones that were buying today have caught the short end of the stick and missed the move and they could be feeling some pain the following session. Im saying this because yesterday the es traded 2.5 million minis which is good and today we advanced higher on less volume alot less, and actually todays volume was less than the 9 previous up sessions we have had and prices are making new highs...Thats a red flag to me. Overall I'm acticipating a consolidation here at these levels i.e. (balance) and eventually a push lower here soon i.e. thats why I posted that es short entery trade setup and I beielive it has a great risk/reward here. Looking for longs up here is dangerous so protect yourself if you think we are oversold or a pullback is in place and USE STOPS! Good Trader Kratrader

Today the ES and the SPO tested downtrend line from the 1368 highs and so far its being respected. Theres a couple things that I want to point out here 1. downtrendline 2. how well it was respected/the back and fill type action I seeing after it traded and now during the globex overnight session. 3. I have been watching the volume closly on the push higher and today looked concerning imo. Im thinking the ones that were buying today have caught the short end of the stick and missed the move and they could be feeling some pain the following session. Im saying this because yesterday the es traded 2.5 million minis which is good and today we advanced higher on less volume alot less, and actually todays volume was less than the 9 previous up sessions we have had and prices are making new highs...Thats a red flag to me. Overall I'm acticipating a consolidation here at these levels i.e. (balance) and eventually a push lower here soon i.e. thats why I posted that es short entery trade setup and I beielive it has a great risk/reward here. Looking for longs up here is dangerous so protect yourself if you think we are oversold or a pullback is in place and USE STOPS! Good Trader KratraderTrader focused on Equities and Futures, Trading Key Reference Area's employing an objective Auction Market Theory approach.

Thursday, June 30, 2011

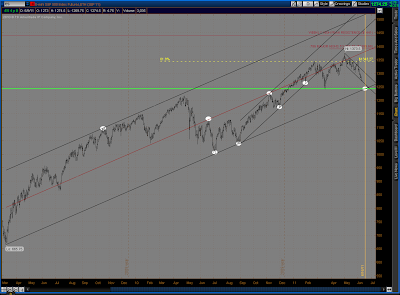

ES Trendline Test

Today the ES and the SPO tested downtrend line from the 1368 highs and so far its being respected. Theres a couple things that I want to point out here 1. downtrendline 2. how well it was respected/the back and fill type action I seeing after it traded and now during the globex overnight session. 3. I have been watching the volume closly on the push higher and today looked concerning imo. Im thinking the ones that were buying today have caught the short end of the stick and missed the move and they could be feeling some pain the following session. Im saying this because yesterday the es traded 2.5 million minis which is good and today we advanced higher on less volume alot less, and actually todays volume was less than the 9 previous up sessions we have had and prices are making new highs...Thats a red flag to me. Overall I'm acticipating a consolidation here at these levels i.e. (balance) and eventually a push lower here soon i.e. thats why I posted that es short entery trade setup and I beielive it has a great risk/reward here. Looking for longs up here is dangerous so protect yourself if you think we are oversold or a pullback is in place and USE STOPS! Good Trader Kratrader

Today the ES and the SPO tested downtrend line from the 1368 highs and so far its being respected. Theres a couple things that I want to point out here 1. downtrendline 2. how well it was respected/the back and fill type action I seeing after it traded and now during the globex overnight session. 3. I have been watching the volume closly on the push higher and today looked concerning imo. Im thinking the ones that were buying today have caught the short end of the stick and missed the move and they could be feeling some pain the following session. Im saying this because yesterday the es traded 2.5 million minis which is good and today we advanced higher on less volume alot less, and actually todays volume was less than the 9 previous up sessions we have had and prices are making new highs...Thats a red flag to me. Overall I'm acticipating a consolidation here at these levels i.e. (balance) and eventually a push lower here soon i.e. thats why I posted that es short entery trade setup and I beielive it has a great risk/reward here. Looking for longs up here is dangerous so protect yourself if you think we are oversold or a pullback is in place and USE STOPS! Good Trader KratraderNFLX levels holding up nicley

Taking profits off of key reference area levels BA JPM

JPM to the penny on the entry, nice zone to zone trade using my key reference area methodology.

JPM to the penny on the entry, nice zone to zone trade using my key reference area methodology. BA good trade here locking profits in on this market push higher. Closed position into gap fill, dont be greedy on these trades lock it in! theres always more setups. Both of these were issued in watchlist.

BA good trade here locking profits in on this market push higher. Closed position into gap fill, dont be greedy on these trades lock it in! theres always more setups. Both of these were issued in watchlist.

Wednesday, June 29, 2011

X United Steel in Key Reference Area/Closing above Trendline

Tuesday, June 28, 2011

Monday, June 27, 2011

Bidu Key Reference Upside Trades

Sunday, June 26, 2011

Watchlist June 27-31, 2011

This JNJ short setup I have been monitoring for quit awhile and its finally showing the type of weakness that I have been waiting to see for me to issue it on a watchlist. This trade setup is important because of the flush up this stock encountered. When these types of runups happen, we can build support (or this thing could puke). It is very important to monitor this trade if the $66 level trades and our setup is active because we could see some serious momo and volatility to the downside in this one. Important downside numbers is the objective #2 of $63 level. If JNJ reaches this level I'm expecting to see an immediate reaction here, but if the selling pressure is intense, $59.50 will a important downside support level for this stock. Note the gaps also on this they could also come into play. Finding the exact downside support number for this one will be difficult, but if it gets to those extreme numbers imo thats a great trade for us (short from $66) Good Trading. Kratrader.

Tuesday, June 21, 2011

Saturday, June 18, 2011

Watchlist June 20-24, 2011

It's techs time! This weeks watchlist is a big one. These are the heavy hitters I like to call them, and they are entering some important levels which I have been watching very closely since putting in there tops. I'm looking for these levels to be extremely important this week because these key reference areas will be defended by large investors, institutions and big time swing traders covering short positions and reversing to go long. When I was reviewing these I got to thinking that these are such important areas that if these trade and the key reference areas are respected and begin to trade higher, that its going to put heavy weight on the rest of the indices and could potentially pull them higher. And IMO the market as a whole will not stop selling until the heavy hitters have bottomed. The following watchlist I have done over the last several weeks consisted of the big banks, and in my eyes they are trying to bottom/have bottom IE. $GS which I have been swing long now for close to 2 weeks with minimal heat on the position. With a extremely volatile market ($VIX breaking out), and $SPX taking a nose dive, $GS has been legitimately holding my key reference are of 132.64 and making a low the day of my entry of 131.50 which still holds today. On to the transportation index, that was last weeks watchlist, and IMO with falling oil prices and the setup that was developing, ($CL_F is still attempting to meet its objective of 87.00 from a short key level of 102.40) I still expect $KSU $UPS to continue higher. So with the wrap up here, I believe that tech is ready for a correction and believe its going to pull the $NASDAQ higher and in return pull the rest of the stock indicies with it. If we want a real bottom in the $ES_F/$SPX the $NASDAQ needs to have the heavy hitters bottom as well. Hope this watchlist was a good one. Good Trading Kratrader.

Tuesday, June 14, 2011

$ZB_F 30-Year/$ZN_F 10-Year

Monday, June 13, 2011

How I trade the market Example $CL_F

Our 86.50 objective has been met. This was a great example of my thought process.

I know this is still in early development phase but I have been watching oil very closely now I think for close to a month, along with gold. I knew a month ago that there was a legit trade opportunity setting up but it was going to take some time to develop. I believe the breakdown here is underway and will get very vertical to the downside within the next session or two. This is how you risk 2 points to try and make 16. Gold was the exact same setup and I believe I posted it on the page here somewhere if you want to see the example just search for it using the search feature, or filter through the archives or scroll through my twitter account. I hop this post helps. Good trading.

I know this is still in early development phase but I have been watching oil very closely now I think for close to a month, along with gold. I knew a month ago that there was a legit trade opportunity setting up but it was going to take some time to develop. I believe the breakdown here is underway and will get very vertical to the downside within the next session or two. This is how you risk 2 points to try and make 16. Gold was the exact same setup and I believe I posted it on the page here somewhere if you want to see the example just search for it using the search feature, or filter through the archives or scroll through my twitter account. I hop this post helps. Good trading. I haven't had an update on crude since the last post so here it is....Its basically just consolidating as of right now we have agreement between the buyer and the seller. this is opportunity here and there will be a trade off of this. everything in my first post is still playing out. and i'm still anticipating and push lower. though time will tell . good trading!

I haven't had an update on crude since the last post so here it is....Its basically just consolidating as of right now we have agreement between the buyer and the seller. this is opportunity here and there will be a trade off of this. everything in my first post is still playing out. and i'm still anticipating and push lower. though time will tell . good trading! I decided to post this crude oil play, because i have been watching it setup now for several days, (and am kinda drooling lol) lots of anaylysts and traders are thinking crude has more room to rally and it very well might. BUT we are setting up in a unique pattern thats is very coiled and when the move happens it will be fast and more than likely with alot of volume behind it. Reason why I posted this is because there is 2 scenerios that can happen here. scenerio 1) we break out of this tight consolidation to the downside (which is what i would like to happen) or scenerio 2) we will break out to the upside and retest recent highs and chop back and forth. this future is very vulnerable and is ready to make a serious move the balance area that has formed is very mature. What ever it decides to do there is several trade opportunites that lie here you can buy the breakout in an initiative type play, or be a responsive buyer at the lows or highs or recent highs. All in all this is a great example of a very mature balance that is about to go to imbalance. Note: one reason why im leaning to more of a bearish bias is because 1.) its memorial weekend and oils just flat out not moving, in the past crude would rip all the way into memorial weekend...maybe oil has gotten ahead of itself??? 2.) we have been pushing up hard for several months. If your not a player in this paticular setup or dont want to trade the crude contract there is several of stocks setting up the same way. Good Trading KraTrader

I decided to post this crude oil play, because i have been watching it setup now for several days, (and am kinda drooling lol) lots of anaylysts and traders are thinking crude has more room to rally and it very well might. BUT we are setting up in a unique pattern thats is very coiled and when the move happens it will be fast and more than likely with alot of volume behind it. Reason why I posted this is because there is 2 scenerios that can happen here. scenerio 1) we break out of this tight consolidation to the downside (which is what i would like to happen) or scenerio 2) we will break out to the upside and retest recent highs and chop back and forth. this future is very vulnerable and is ready to make a serious move the balance area that has formed is very mature. What ever it decides to do there is several trade opportunites that lie here you can buy the breakout in an initiative type play, or be a responsive buyer at the lows or highs or recent highs. All in all this is a great example of a very mature balance that is about to go to imbalance. Note: one reason why im leaning to more of a bearish bias is because 1.) its memorial weekend and oils just flat out not moving, in the past crude would rip all the way into memorial weekend...maybe oil has gotten ahead of itself??? 2.) we have been pushing up hard for several months. If your not a player in this paticular setup or dont want to trade the crude contract there is several of stocks setting up the same way. Good Trading KraTrader

Friday, June 10, 2011

$6E_F $6B_F kra's holding up nicly on 6e, 6b next victim

$6B_F has a nice pin bar form off level 1.6064 this produces a new target level. I anticipating a minor pullback/consolidation the following session then continuation to meets its new objective of 1.6302. All in all this was a great entry with hardly no heat, stops and such should be adjusted and the trade should be managed accordingly. Good trading Kratrader.

$6B_F has a nice pin bar form off level 1.6064 this produces a new target level. I anticipating a minor pullback/consolidation the following session then continuation to meets its new objective of 1.6302. All in all this was a great entry with hardly no heat, stops and such should be adjusted and the trade should be managed accordingly. Good trading Kratrader.Thursday, June 9, 2011

Gold Update

Wednesday, June 8, 2011

Tuesday, June 7, 2011

Watchlist

i'm liking what i'm seeing here in both cme and cboe. these 2 have been beaten up lately, and cme is inside of a kra zone, and cboe will be entering it shortly. i will be monitoring cme activity in side of kra zone and if i start seeing market development/bottoming formation around the 266 level i will be taking a long position. same as for cboe. this are small risk large reward plays. similar to my goldman entry. tab for clues good trading!

Subscribe to:

Comments (Atom)