Trader focused on Equities and Futures, Trading Key Reference Area's employing an objective Auction Market Theory approach.

Friday, September 28, 2012

Thursday, September 27, 2012

Wednesday, September 26, 2012

6E Futures Daily/Pulling into Support

++6_7_2012+-+9_26_2012.jpg) | ||

| 6E Futures Daily Chart |

Tuesday, September 25, 2012

MCD Daily The "Confluence Cross" Marking the Spot

++3_28_2012+-+9_25_2012.jpg) |

| Today the "Confluence Cross", Marking the Spot in our last MCD post occurred and we saw $MCD put in a head fake above point #2 just to sucker in a few fresh longs but then to reverse to squeeze these new longs out of there positions. Now we are seeing a shift in pattern and a 2 day key reversal bar unfolding. In the next coming sessions I expect $MCD to see continued weakness and selling pressure as this move targets $91 for its 1st objective and a break of $91 targets the lower extreme of the range. |

Monday, September 24, 2012

Thursday, September 20, 2012

Tuesday, September 18, 2012

Euro /6E Daily ...Extended, Setting up Negative

Friday, September 14, 2012

BA (Boeing) Daily Chart

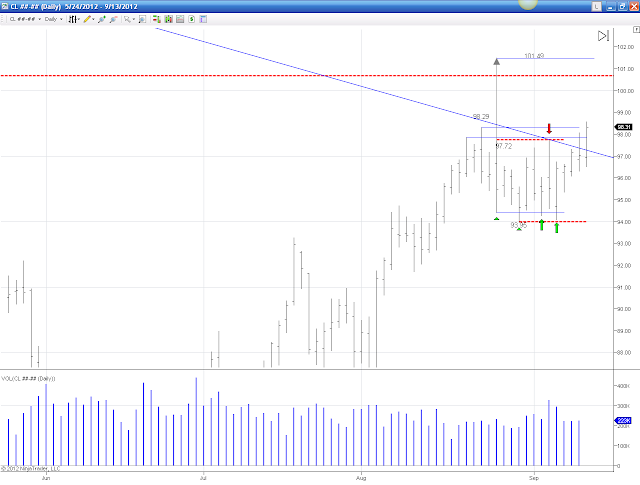

Thursday, September 13, 2012

Wednesday, September 12, 2012

Gold Weekly Inverted Head & Shoulders Pattern

IBM Daily

30 Year Bond Head and Shoulders

Tuesday, September 11, 2012

Sunday, September 9, 2012

Wednesday, September 5, 2012

Emini S&P 500 Futures Daily Chart

|

Gold Weekly Chart

|

| Gold Weekly - New support forming at 1600.00...1520 level acted as support as 3rd test formed ba (consolidation ) into area http://www.kratrader.com/2011/08/gold-got-parabolic-swing-trade-short.html |

Subscribe to:

Posts (Atom)

++8_9_2012+-+9_28_2012.jpg)

++6_29_2012+-+9_28_2012.jpg)

++8_21_2012+-+9_26_2012.jpg)

++7_6_2012+-+9_26_2012.jpg)

++8_2_2012+-+9_24_2012+site.jpg)

++2_15_2012+-+9_20_2012.jpg)

++5_16_2012+-+9_18_2012.jpg)

++4_5_2012+-+9_13_2012.jpg)